How a Cash-Out Refinance Works and Uses of It?

Nov 17, 2023 By Triston Martin

Financial flexibility and strategic planning sometimes overlook the "Cash-Out Refinance Money." This new mortgage management method lets homeowners access their home's equity and offers up financial possibilities.

How a Cash-Out Refinance Works?

Before discovering the vast landscape of possibilities, let's take a moment to grasp how a cash-out refinance works. A cash-out refinance includes refinancing your mortgage for more than the sum. The extra cash might be used for several purposes.

Application and Approval

The procedure starts with a lender application, like a mortgage. The lender will evaluate your credit, income, debt-to-income ratio, and house worth. Meeting the lender's requirements is crucial for approval. These cash-out refinance requirements may include a minimum credit score, a stable income, and a specific loan-to-value ratio (LTV).

Property Appraisal

The lender will order a professional property appraisal to evaluate your property's worth. This assessment updates your home's value, which is crucial to determining the maximum refinance cash.

Calculating the Loan Amount

Your home's assessed valuation, mortgage debt, and lender's maximum LTV limit determine how much you may cash out. Lenders usually lend up to 80% of house equity.

Loan Terms and Interest Rates

After approval, you'll see the interest rate, monthly payment, and loan length. These terms may change from your original mortgage, so read and understand them.

Closing Process

Signing legal documentation completes the cash-out refinancing, like a mortgage closing. These documents specify the new loan's conditions and amount. Refinance closing expenses may include application, appraisal, and other fees.

Receiving the Cash

After closing, cash-out refinancing monies are distributed. Payment might be a flat sum or a straight deposit into your bank account.

Using the Funds

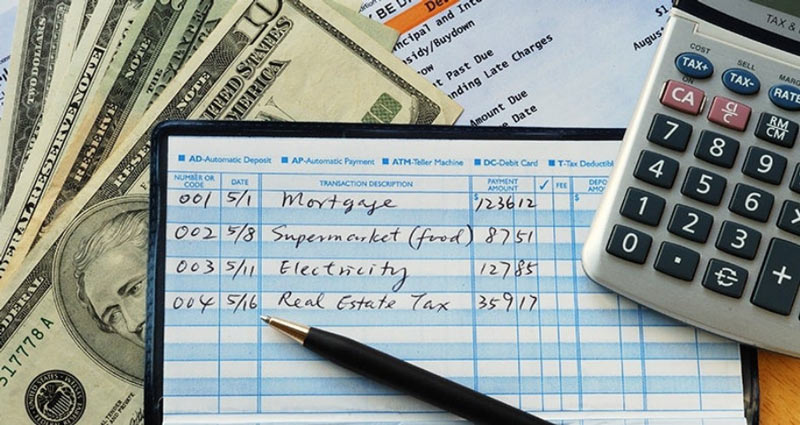

The cash-out refinance money is now at your disposal for various purposes. Home upgrades, debt consolidation, education, investments, emergency cash, and more may be done with it. It's crucial to determine how to spend the assets to reach your financial goals.

Repayment and Impact on Mortgage

The cash-out refinance creates a new mortgage with updated terms. Your monthly payments will depend on the new loan amount, interest rate, and period. Remember that extending your loan term may take longer to pay off your home. Consult tax professionals since the new loan's interest may not be tax-deductible for some uses.

Main Uses of Cash-Out Refinance Money

Now that we understand cash-out refinancing and its conditions let's explore its intriguing prospects.

Home Improvements and Upgrades

Cash-out refinancing money is often used to invest in your most important asset, your home. A monetary infusion may turn your idea of a sleek modern kitchen, sumptuous master bedroom, or stunning garden sanctuary into reality. From property value improvements to lifestyle improvements, cash-out refinancing money may impact your life.

Debt Consolidation

For those juggling multiple high-interest debts, cash-out refinance money can offer a path to financial liberation. By consolidating credit card, personal, and vehicle bills into one mortgage payment, you simplify your finances and generally get a reduced interest rate. This method simplifies financial management and may save money over time.

Pursuing Higher Education

Education is an investment in oneself, and cash-out refinance money can fuel that investment. Whether you're aiming to enhance your skills, pursue an advanced degree, or support a loved one's educational journey, the cash infusion can alleviate the burden of tuition fees, textbooks, and other educational expenses.

Venturing into Entrepreneurship

Entrepreneurial dreams can be nurtured with the help of cash-out refinance money. Launching a new business or expanding an existing one requires capital, and the cash infusion can serve as the cornerstone of your business endeavor. From establishing a physical storefront to investing in inventory and marketing, the possibilities are as diverse as the world of entrepreneurship itself.

Creating a Financial Safety Net

Life is unpredictable, and having a robust emergency fund can provide peace of mind during challenging times. Cash-out refinances money can be channeled into creating or bolstering your emergency fund, ensuring you have the resources to navigate unforeseen medical expenses, job loss, or other unexpected financial setbacks.

Investing for the Future

The world of investments beckons, and cash-out refinance money can provide the capital needed to dip your toes into various investment avenues. Whether you're intrigued by stocks, bonds, real estate, or other opportunities, the infusion of funds can be your ticket to potentially growing your wealth over time.

Retirement Planning Redefined

Securely nestling funds for your golden years is a hallmark of wise financial planning. By directing cash-out refinance money toward retirement accounts such as IRAs or 401(k)s, you're fortifying your financial future. This strategic move not only positions you for a comfortable retirement but also takes advantage of potential tax benefits.

Embarking on Grand Adventures

From exotic vacations to daring escapades, cash-out refinance money can make your travel dreams come true. Whether you're yearning to explore new cultures, relax on sun-soaked beaches, or traverse the great outdoors, the financial infusion can open the doors to unforgettable experiences.

Celebrating Life's Milestones

Life's significant moments deserve celebration, and cash-out refinance money can fund these joyous occasions. Whether it's a lavish wedding, a milestone birthday, or a family reunion, financial flexibility allows you to commemorate life's precious moments without compromising your financial stability.

Maintaining and Enhancing Your Home

Beyond major renovations, cash-out refinance money can also be directed toward essential home repairs and maintenance. Keeping your home in prime condition ensures your comfort and safety and preserves its long-term value.

Closing Words

Cash-out refinancing money is a gateway to many possibilities. The possibilities are endless, from house renovation to entrepreneurship financial security to life experiences. However, this path must be carefully considered. Financial counselors, mortgage specialists, and other professionals will help you make decisions that match your objectives and finances. Remember that every cash-out refinancing decision you make may influence your financial journey and empower your aspirations.

Triston Martin Dec 12, 2023

Stocks That Are Giving Investors Big Buybacks

96174

Susan Kelly Jan 20, 2024

What Amount of Life Insurance Is Advisable?

79883

Susan Kelly Oct 15, 2023

Jewelry Insurance: All the Information You Need

7324

Susan Kelly Jan 03, 2024

Investors' Obsession With Profitability And Why It Matters

17348

Susan Kelly Oct 13, 2023

PNC Student Loans

46741

Susan Kelly Oct 14, 2023

What Credit Score Do I Need to Buy a House?

26637

Triston Martin Nov 22, 2023

Navigating Charge-Offs: Understanding, Impact, and How to Deal With Them.

578

Susan Kelly Oct 20, 2023

A Floating Interest Rate Is Exactly What?

92089