Hedging vs Speculation: An Overview

Feb 12, 2024 By Susan Kelly

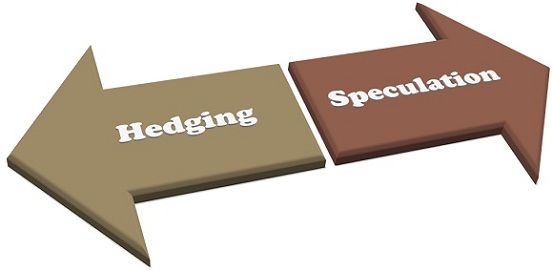

Hedging and speculation are investment-related strategies and trading, while hedgers and speculators refer to investors and traders of a certain type. In addition to being both sophisticated strategies, hedges and speculation are very different. Speculation is the process of trying to make an income from the change in the price of a security, and hedging aims to minimize the risk or volatility in an increase in the value of a security.

Hedging is a strategy to reduce the fluctuation associated with an asset's cost by taking offset positions in it. This is opposite to what an investor is currently doing. The primary goal of speculation is to make money from investing in the direction an asset is likely to move.

Hedging

Hedging is the process of taking an offset (that is, opposite) position in investment to offset any gains or losses that occur in the assets (the one that supports the derivative). When taking a position opposite, the hedgers try to shield themselves from whatever happens in terms of price, and the asset can cover all bases, so think of it. The ideal scenario for hedges is to create one effect that cancels out the other. It's a risk-neutralizing strategy.

As an example, suppose a company that specializes in making jewellery. It has a large order to be completed within six months. It will be a project that requires an abundance of gold. The company is concerned about the fluctuations in the gold market and believes that the price of gold could rise significantly within the next few months. The company could purchase a 6-month futures contract for gold to safeguard its business from the uncertain future and ensure that it is protected. In this way, if gold sees an increase of 10 and the futures contract is purchased, it will guarantee a price which can offset this increase.

You can see from the above that while hedge fund managers are protected from damages, they're limited to any gains. The portfolio is diverse but exposed to systematic risk. Based on the policies of a company and the kind of business it operates, it could decide to hedge against specific business operations to minimize fluctuation in profits and protect itself from risks that could be a downside.

To limit the risk, investors hedge the portfolio by shorting futures contracts traded on the market and purchasing put options to protect the portfolio's long positions. However, when a speculator is aware of the situation, they might decide to sell the exchange-traded fund (ETF) as well as an option to purchase a futures contract in the market to earn some profit on an eventual downturn.

Speculation

Speculators trade based on their best guesses of the market's direction. For instance, if a person believes that a particular price is too high, they might trade the stock in shorts and then wait for the price to fall, and at that point, it could be repurchased to make profits. Speculators are at risk of the upside and downside of the market. Consequently, they are very risky. However, when they win, they can win huge, unlike hedgers, who strive more towards protection than profits.

If hedgers are considered risk-averse, the speculators may be described as risk-averse. Hedge funds seek to mitigate the risk associated with uncertainty, whereas speculators place bets on the market's movement, hoping to profit from changes in the value of securities. Both can be afloat against the current market sentiments, but they do it with completely different motivations.

Special Considerations

It's important to understand that hedges are not the same as broadening your investment portfolio. Both involve counterbalancing; that's the truth. Diversification is a general approach to managing portfolios that investors employ to reduce risk across all their assets. Hedges can help reduce losses by acquiring an offset position in the specific asset. If an investor is looking to lower their risk, they shouldn't invest all their funds into one investment. Investors can divide their money across several investments to lessen risk.

For instance, suppose that the investor had $500,000 in funds to invest. The investor can diversify his portfolio and invest the money in various classes of investments: multiple different sectors of stocks and real estate, and bonds. This method helps diversify risk that is not systematic; it shields investors from getting impacted by any one event during investing.

Investors who are concerned about a price decline in their investments could hedge to protect themselves against losses. For instance, suppose the investor has invested 100 shares of an oil company XYZ and believes the recent decline in oil prices could affect the company's earnings.

Triston Martin Dec 12, 2023

Stocks That Are Giving Investors Big Buybacks

29644

Susan Kelly Dec 06, 2023

What You Need To Know About Loan Comparison Calculator

30849

Susan Kelly Dec 08, 2023

Ethos Life Insurance

73819

Triston Martin Oct 15, 2023

Here Are 2022's Top United Airlines Credit Cards

18415

Triston Martin Nov 30, 2023

Understanding Gap Insurance: A Comprehensive Guide

35310

Susan Kelly Nov 27, 2023

Surveys for Money

23604

Susan Kelly Oct 11, 2023

Cracking the Code: Dealing with the Six Most Frequent Tax Issues in the Gig Economy

29421

Triston Martin Dec 09, 2023

Low-Risk Dividend Stocks to Buy

71048