How Can You Pay Your Property Tax Bill?

Feb 05, 2024 By Triston Martin

Being a homeowner means getting a property tax bill. These taxes are collected by local governments to help pay for initiatives and programs that benefit the whole neighborhood, including infrastructure, education, emergency services, and law enforcement. As part of each monthly mortgage payment or straight to your local tax office, you may pay your property taxes.

Ad Valorem Tax

An ad valorem tax is a tax based on an item's assessed value, which is why property taxes are so high. An appraiser estimates the fair market value (FMV) of your property, which is the price that a buyer and a seller would agree to in an open market. Comps" are properties in similar condition, characteristics, and size that have recently sold in the area and have been analyzed by the assessor. The property's rental revenue history (or prospective), replacement costs, maintenance expenses, and any recent changes you've made to the property may also be taken into consideration by the assessor.

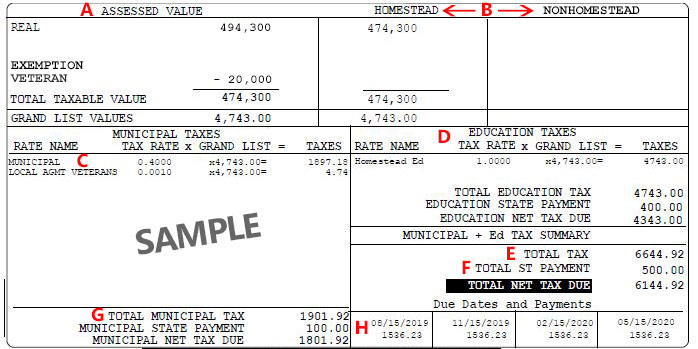

Calculating Property Tax

The tax office multiplies the assessed value of your property by the applicable local tax rate to calculate your tax obligation. You will owe $2000 in property taxes if your house is valued at $200,000 and the municipal tax rate is 1% of that amount. The greater the assessed value, the larger the tax bill will be; it should go without saying. The tax rate is applied to just a fraction of the assessed value by certain local governments. The assessment ratio is a term for this. An assessment factor of 80% and a 1% tax rate in your county mean that your annual tax payment will be $1,600 ($200,000 divided by.80 and.01).

Methods for Paying Property Taxes

Taxes may be paid in two ways: via your monthly mortgage payment or by visiting your local tax office:

Financial Institution or Bank

Using your bank, credit union, or any other financial institution to pay your property taxes is an option. You should always check with your bank or other financial institution before making a payment in order to avoid delayed payment penalties. Banks handle afternoon payments with the following business day's date.

Bill Payment Service

There are bill payment options available at most banks and other financial organizations. You may pay bills online, at an ATM, via phone, or in person at your bank. To pay property taxes online, add Rural Property Taxation as a payee to your bank account. Payee name, as well as your folio number, are required to make a new payment to your bank account.

If you want to pay by mail, you will need to send a check, a bank draught, or a money order that is made out to the Minister of Finance. Write the folio number of your property on your payment so that your account may be readily recognized when your payment is completed. Don't forget to provide enough time for our office to receive your payment before the due date. Payments made after the date of the postmark will not be accepted.

Personal Property Taxes

You may think of your land and any related property as your "real estate." This sort of property is often discussed in relation to property taxes. It's possible that you'll have to pay more than just the property tax on your home. You may also have to pay taxes on your personal property, depending on where you reside. Both physical and intangible assets may be grouped into two categories: tangible assets (like a vehicle or boat) or intangible assets (like an insurance policy or even an intellectual property). A personal property tax is an ad valorem tax, which means it is based on the property value itself, much like real property taxes. In general, as the value of tangible personal property drops, so do the taxes that are levied on it. The calculated intangible value determines intangible personal property taxes (CIV).

Conclusion

Property taxes are owed by everyone who owns real estate, regardless of whether it is a home, a farm, or a piece of undeveloped ground. While you cannot avoid paying property taxes, you may deduct up to $10,000 in total state and local taxes, which includes property taxes. Mortgage payments include property taxes, but you can't take a tax deduction until your lender pays the tax on your behalf. If you have any queries regarding the payment plan, please contact your lender.

Susan Kelly Nov 27, 2023

Surveys for Money

55859

Susan Kelly Dec 25, 2023

FHA Loan Costs

4327

Susan Kelly Dec 21, 2023

Top 4 Strategies to Short the S and P 500 Index (SPY)

96842

Susan Kelly Oct 03, 2023

What Is The Standard Plan For Repaying Student Loans

97740

Susan Kelly Nov 17, 2023

The Top Installment Loans For Poor Credit Scores In 2022

16248

Susan Kelly Dec 04, 2023

Navigating the Basics of Phillips Curve: A Detailed Guide

60920

Susan Kelly Oct 28, 2023

Watch TV Shows Online for Free

61835

Susan Kelly Oct 15, 2023

Jewelry Insurance: All the Information You Need

26436